Looking for sustainable disability insurance? Then you've come to the right place! Most people love their job! But due to accidents, illnesses or countless other reasons, it often happens that you can no longer perform your job permanently. In order to secure your working capacity and income for such cases, it makes sense to invest in a private occupational disability pension.

Since insurance companies invest the regular premium payments on the capital market and we jointly achieve the best possible sustainable lifestyle you should specifically opt for green occupational disability insurance.

In this article, I'm going to explain everything you need to know about disability insurance - from the definition, causes, sustainability and benefits, to the tips you should consider when making your decision. Let's go!

Here you can find a short overview in advance:

Definition: What is occupational disability insurance (DI)?

An occupational disability insurance (also called BU or BU insurance) is a Insurance that protects you against the consequences of a possible occupational disability and secures your regular income.

One is considered incapacitated for work, if one can no longer perform one's profession permanently or only partially. The insurance company will then pay you a monthly disability pension if you cannot perform more than 50 percent of the tasks in your current job for at least six months (or permanently).

Causes: What are the most common causes of occupational disability?

The causes of occupational disability are manifold and usually occur unexpectedly. That's why, as long as you're healthy, it's hard to imagine that you'll actually have to claim an occupational disability pension. But actually one in four will become occupationally disabled at some point in their lives.₁

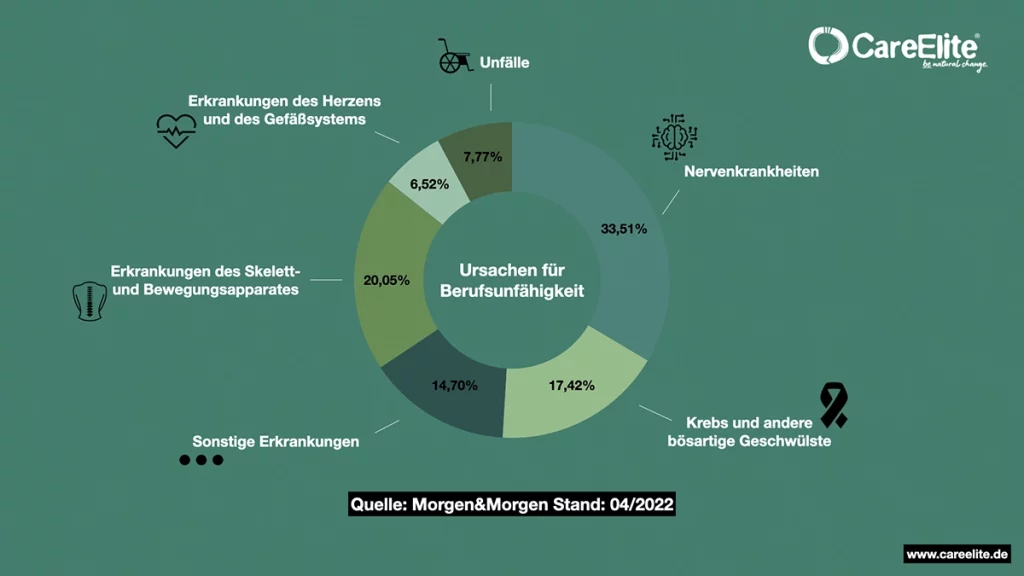

Based on data from the independent analyst firm Morning&Morning I will now start by presenting the most common reasons why people become unable to work:

- 33,51% Nervous diseases/mental illnesses (e.g. Burnout, depression, anxiety and obsessive-compulsive disorders, or addictive disorders).

- 17,42% Cancer and other malignant tumors (e.g. breast cancer or testicular cancer)

- 20,05% Diseases of the skeletal and musculoskeletal system (e.g. spine or back muscles)

- 7,77% Accidents (e.g. car accident or accident at work)

- 6,52% Diseases of the heart and vascular system (e.g. high blood pressure or stroke)

- 14,07% Other diseases (all other diseases)

Sustainability: What makes sustainable disability insurance better?

Okay, so you need it! But why does occupational disability insurance have to be sustainable? Who has a environmentally friendly lifestyle should not stop with this positive attitude when it comes to their own insurance policies.

After all, insurance companies are among the largest investors in Germany and usually invest your regular insurance premiums conventionally on the capital market. Over your entire professional career, that adds up to a large sum that can make a big difference in the world.

In order to exclude that your money is used for example to support coal companies, toxic waste transports, child labor or the production of weapons of war, it is therefore worthwhile to make a direct responsible and future-oriented insurance company or at least select a corresponding tariff.

This way, you can exclude the direct or indirect support of controversial industries and companies - and at the same time promote ecological and social business fields.

Here are some Examples of knockout criteria and OK criteriaThese are some of the factors that should play a role in your final decision for a green occupational disability insurance:

K.O criteria (Investments in these areas are excluded)

- Weapons and armor

- Labor and human rights violations

- Child labor

- Nuclear power

- Genetic engineering

- Agro-Chemical

- Fossil fuels

- Toxic waste transports and exports

- Industrial animal husbandry

- Gambling

- …

OK criteria (Investments in these areas are desired)

- Climate protection

- Resource conservation

- Equal opportunities

- Sustainable business relationships

- …

Advantages: Why take out a BU in the first place?

Now you know why you should sustainably insure your income and labor. But What are the general reasons for taking out occupational disability insurance??

Logically, I also asked myself this question before I took out insurance. Accordingly, I can tell you here all the advantages that I personally have recognized with the BU.

Flexible pension payments

You can set the fixed occupational disability pension to suit your own income and lifestyle. Most insurance companies are also flexible in the event of payment difficulties.

Social security

The occupational disability insurance secures one's standard of living and takes the pressure off. In contrast to state assistance, it really does protect against a possible social decline due to a drop in income. The pension for reduced earning capacity is significantly lower.

Good savings opportunities

Those who are healthy, do not have an overly risky job, and enjoy insurance coverage at a young age benefit especially from a much lower monthly insurance premium.

Immediate insurance coverage

If you want or need to take out disability insurance, you do not have to observe any waiting periods. Unlike the statutory pension for reduced earning capacity, you enjoy full insurance coverage as soon as you sign the contract.

No strict criteria

The full occupational disability pension is already paid from an occupational disability of 50%. This means that you will receive the insurance benefit even if you could theoretically still perform many of the tasks of your profession. By comparison, the state pension for reduced earning capacity only applies if you can no longer perform any occupation at all.

Cause independence

You enjoy individual insurance cover, the benefits of which are independent of the cause. Are you incapacitated by definition? Then you will also receive full benefits for the duration of your disability.

Does the occupational disability insurance also have disadvantages?

In Germany, after all about 14.31 million an occupational disability insurance If all this is so great, why doesn't everyone have BU? That's because it also has a few disadvantages and disadvantageous aspects, of course.

Depending on how risky one's profession is, the amount of the occupational disability pension, or how healthy and old one is when taking out the contract, the coverage of one's own working capacity can be also relatively expensive be. That is why it is important to have occupational disability insurance to be completed at a young age if possible. For example, I have had my own disability insurance since I started my career.

In addition, the Health check understandably very strict - not everyone can take out a BU. Also a False advice cannot be completely ruled out. However, the latter applies to any product that requires individual consultation.

Benefit: When does sustainable disability insurance make sense?

Now you know the benefits and criticisms of a BU. But when and for whom is the Occupational disability insurance makes sense? Since the state insurance against occupational disability is usually not sufficient, it can be said that a private occupational disability insurance (BU) is the best solution. makes sense for all those who depend on their regular income from work.

A So occupational disability insurance is worthwhile for almost all of us. And sustainable occupational disability insurance even more so - after all, everyone benefits if we learn to use our planet's resources sparingly.

But for certain groups, private occupational disability insurance generally pays off even more. For example for Self-employedmost of whom have no statutory pension insurance. Trainees and students also benefit from occupational disability insurance because it is much cheaper at a young age.

Are there also people for whom sustainable disability insurance makes little sense? In fact Officials and civil servantswho already have many years of service under their belt often do without occupational disability insurance. This is because they receive a pension, which in many cases is sufficient to ensure their standard of living even in the event of occupational disability. If this is not the case, it can make sense to take out an additional Service disability insurance complete.

Tip: In another blog article, I also gave you my top tips for a sustainable car insurance compiled. Be sure to take a look!

5 tips: What should I look for when choosing my green disability insurance?

Now you already know quite a bit about private disability insurance. But there are still a few things you need to consider when making your final decision on a particular tariff. absolutely note should. Here I would like to give you a few tips so that you definitely make the right choice and can look to the future with peace of mind.

1. the term "sustainable" is not protected

Note that the term "sustainable" is not protected by law and can be used freely by companies. It is therefore important to look at sustainability standards and the philosophy of the respective insurance companies.

For example, is there a Sustainability Advisory Boardwho decides on the investments? Will a green Investment Policy pursued? Is the company transparent and provides policyholders with a Change history of one's own sustainable actions over time? These questions need to be answered.

2. choose the appropriate pension amount

Fortunately, most occupational disability plans allow you to protect up to 80 percent of your income. However, this income protection does not protect you from potentially having to massively regulate your accustomed standard of living when you You were wrongly advised in the choice of your pension amount have been.

A reasonable guideline would be that you you cover at least 50% of your previous net incomebut definitely not less than 1000 euros. You should not skimp in any case.

3. protect yourself with dynamic premiums

Over the years, inflation contributes to the fact that our money is worth less and less. Accordingly, you should make sure that your Automatically adjust monthly insurance premiums and steadily increase somewhat over time.

4. take out your BU at an early stage

The earlier you decide on a sustainable occupational disability insurance, the better. On the one hand, because you have secured your own working capacity from the day of signing - on the other hand, because you have still young and healthy are and from right favorable insurance premiums profit.

5. check the contract for clauses and definitions

Some insurers:inside integrate the so-called "abstract reference clause" in their contracts. It ensures that, in the event of occupational disability, you will have to look for other professions that you may still be able to perform. A modern occupational disability insurance will do without such clauses.

Furthermore, you should take a close look at the Definition of occupational disability throw. At what point can your attending physician certify that you are unable to work? Keep in mind that some time may pass between the cause and the medical certificate, during which you may have to keep your savings afloat.

Provider: Where should I buy my sustainable BU insurance?

There are now some green insurance policies on the market that meet most of the essential sustainability criteria. Greensurance, LV 1871 or Concordia, to name just a few of them.

With these companies, you can take out your environmentally and socially responsible occupational disability insurance with a clear conscience - and basically make a positive difference in achieving sustainability goals along the way. This is because all of the insurers mentioned follow clearly defined guidelines and operate an transparent, green investment policy.

When it comes to your occupational disability insurance, the decision in favor of a sustainable product should play an important secondary role. However, it is more important that the contract contents fit your individual needs.

FAQ: Answers to the most frequently asked questions about occupational disability insurance

Which is better accident insurance or occupational disability insurance?

Accident insurance covers you if you suffer a permanent impairment as a result of an accident. However, accidents account for only a fraction of the typical causes of occupational disability.

It is much more common for people to become unable to work due to mental illnesses or diseases of the skeletal and musculoskeletal system, for example. Accordingly, accident insurance cannot replace occupational disability insurance, which protects your income and standard of living for the entire rest of your professional career.

When is one considered incapacitated for work?

A person is considered to be incapacitated if he or she is no longer able to pursue his or her current occupation for at least six months and beyond that for an indefinite period of time, or if he or she is only able to pursue it for a maximum of 50 percent of his or her usual working hours.

Do occupational disability insurances pay at all?

In fact, according to the German Insurance Association, about 80 percent of all applications for occupational disability pensions approved.

Anyone who can no longer perform their job permanently (i.e. for at least 6 months upwards) or can only perform less than 50 percent of their usual working hours/tasks will therefore normally also receive the insurance benefit. The worries about the insurance possibly not paying in the event of a claim are unjustified.

A (sustainable) occupational disability insurance is one of the most important insurances

Insuring one's own income and working capacity is one of the most important decisions in one's life. Some of my friends are already benefiting from regular BU payments, even though they are all still relatively young. You never know what will happen to you in the course of your life. Even a stroke of fate, permanent stress or a car accident through no fault of your own can mean that you can no longer pursue your profession.

After reading this article about sustainable disability insurance, you now know what to look for when choosing your insurance and why sustainability plays an important role. The ecological, social and ethical investment of your insurance premiums can make a lot of positive difference. However, it should be even more important for you to insure yourself against a possible occupational disability in the first place.

I hope I was able to help you with this post about disability insurance. Do you have any questions, tips or your own experiences with a sustainable disability pension that you would like to share? Then feel free to write me a comment under this article.

Stay sustainable,

PS: I also gave you a detailed blog post about the sustainable, statutory health insurance which you should definitely take a look at now.

References:

₁ F. Müller, ZEIT Online: "Jeder Vierte wird irgendwann berufsunfähig" (as of 10.11.2022), available at https://www.zeit.de/arbeit/2021-10/berufsunfaehigkeit-versicherung-versicherungsabschluss-verbraucherzentrale-unternehmen-jana-klug. [19.01.2023].