Do you have a great start-up idea, but don't yet know how to finance your potential start-up? Then you've come to the right place! When I started CareElite, I was in a similar situation myself. I knew that I wanted to offer plastic-free alternatives to cheap, waste-generating disposable items and set up my sustainability blog. But of course I also needed the necessary small change.

In the end, I somehow managed to finance the project from my own funds and the slowly increasing income. Of course, this doesn't work for every project. That's why you should take a close look at the different options that founders have in order to quickly obtain the start-up capital to start a business.

In this article, I would like to introduce you to the most important financing options for a start-up. Use them to turn your start-up idea for a company with added value for the environment and society into reality. Let's go!

10 possibilities: How can founders finance their (sustainable) startup?

The financing of a start-up usually takes place in different phases, which you should definitely be aware of: The process begins with the Early Stagein which the product is designed, the company is founded and the project is launched. This is followed by the First Stage (build-up and growth phase) and finally the Later Stagein which the start-up is established on the market, regularly generates profits and expands.

Depending on the phase, different forms of financing can also be considered. And in order to obtain capital from investors or banks, you usually also have to fulfill the following things or requirements:

- Business plan: It provides a framework for your start-up idea and also includes the target group, market, marketing, legal form and the team you want to work with. Without a business plan, there is usually no financing.

- Financial plan: The financial plan is part of the business plan and sets out the financial feasibility of the start-up project and its potential development. Among other things, it specifies how much start-up capital is required.

- Pitch deck: This is a short, written summary and presentation of your business idea that should convince potential investors. It is therefore essential to make it clear what the day-to-day added value of your startup is.

Everything clear? Then we can now look at the different financing options for Sustainable start-ups to you. I'll also list the key advantages and disadvantages in each case to make your decision at least a little easier.

Just this much in advance: The form of financing you choose should not only depend on whether you can raise the money you need quickly, but also on how well it suits your project.

1. bootstrapping

With bootstrapping, you finance the start of your company out of its own pocket and/or through income from current business. That's how it worked for me.

However, this was also because the start-up capital required for my rather digital project was limited. So in individual cases to weigh up and calculatewhether you can and should finance your business start-up from your own resources.

Advantages:

- Full control and flexibility

- No high interest costs for potential start-up loans

- Great motivation due to the investment in your own business

- No dependence on external investors

Disadvantages:

- Limited growth rate creates advantages for the competition

- Founders are subject to personal, financial burdens

- Network and know-how needed to get started

2. borrowing

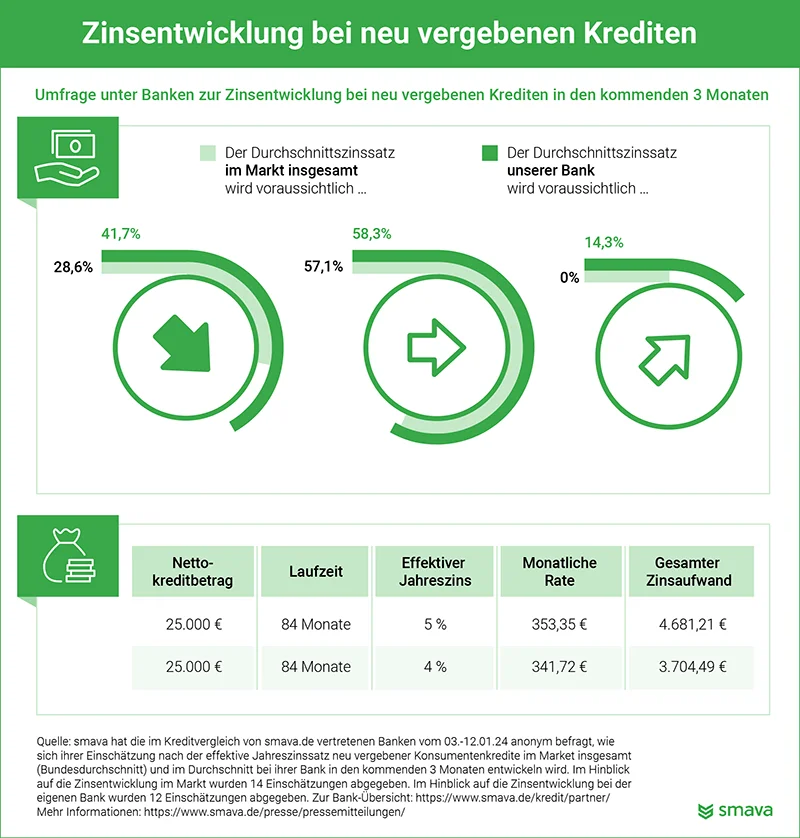

Taking out a loan is a form of Debt financing, where you borrow money externally from banks or other lenders to set up a businessthat you pay back in installments. In theory, it is even possible, without any equity at all.

For lending to the self-employed and business founders, however fulfill some requirements. Among other things, it requires a good credit rating and professional and commercial aptitude.

Advantages:

- Planning security and full control over your startup

- Possibility of raising capital quickly

- Interest paid is tax deductible

Disadvantages:

- Interest costs and repayment obligations arise

- Credit check and collateral are required

- Mostly limited flexibility in the use of funds

3. crowdfunding

Crowdfunding is a very popular method of financing in which a large number of people contribute small amounts of moneyto finance your project. This so-called swarm financing usually works via a presentation on a crowdfunding platform. Supporters usually receive the advertised product in return if the launch is successful.

Advantages:

- Access to a broad base of potential investors

- The idea is more important to supporters here than profit

- Early feedback and high customer loyalty

- Lower risk for individual investors due to small minimum amounts

Disadvantages:

- Success depends heavily on the presentation and marketing of the idea

- Platform fees and transaction costs generally apply

- No long-term financing solution for a growing startup

4. crowdinvesting

The so-called Crowdinvesting is another popular form of startup financing. Compared to crowdfunding, this usually involves much larger sums of money - and long-term collaboration between founders and investors. Although the latter have no co-determination rights, but benefit from a return on investmentwhich they receive in the form of profit sharing, among other things.

Advantages:

- Access to large sums of capital without giving up company shares

- Opportunity to benefit from a broad spectrum of investors

- Potentially lower costs and flexibility in financing

Disadvantages:

- High (campaign) costs and no guaranteed success

- Publication of important corporate planning information required

- Risk of legal disputes and reputational damage in the event of failure

5. business angels

A business angel is Wealthy, private individuals or groupswho invest a lot of money and know-how in your startup right from the early founding phase.

They are usually entrepreneurs themselves, know the industry, usually also bring a large network with them, are close to the founding team and generally also act as mentors.

Advantages:

- Financial support and expertise

- Access to valuable investor networks

- Flexibility in the negotiation of conditions

- Personal interests and sympathy are usually more important than quick profit

Disadvantages:

- Slight loss of control and interference in the business

- High demands on transparency and returns

- Potential conflicts in strategic decisions

6. venture capital

Venture capital is a form of start-up financing in which professional investors with large sums of money (usually several 100,000 euros) in your promising company in order to benefit from growth and high returns.

These so-called Venture capitalists usually get involved in the "later stage" when it comes to concrete growth and expansion plans. However, they can also be on board in the early stages of the company.

Advantages:

- Large sums of capital available for rapid growth

- Access to specialist knowledge and industry contacts

- Support with business strategy and corporate development

Disadvantages:

- High expectations of investors in terms of returns

- Loss of control due to loss of co-determination and information rights

- High growth pressure and drifting away from own ideas

7. family & friends

Even your own Family and friends of founders can be an important source of funding for your startup. Especially because the people in your immediate environment are probably happy to provide capital to help you with your project. However, you should definitely discuss the risks of this form of financing with all parties involved.

Advantages:

- Trust and flexibility in financing

- Fast capital procurement without formal processes

- Usually low or no interest and flexible repayment terms

Disadvantages:

- Risk of tensions and conflicts in the personal environment

- Lack of professional expertise and support

- Limited financing options

8. state subsidies, grants and scholarships

If you are a sustainable startup want to found a company, you can also Financial support programs and government initiatives and obtain favorable development loans and start-up grants. Here I have listed some examples of programs offered by the federal government, the federal states or the European Union:

- KfW start-up promotion (e.g. ERP start-up loan - StartGeld)

- NBank start-up grant

- Start-up grant from the Federal Employment Agency

- EXIST Start-Up Grant

As a rule, however, it is important that you know the respective Application before the start of business activities.

Advantages:

- Financial support, promotion of innovation and coaching

- Lower interest rates compared to traditional financing methods

- Long repayment periods or even non-repayable subsidies

Disadvantages:

- Strict requirements and cumbersome bureaucratic processes

- Limited availability of funds and fierce competition for funding

- Restrictions on the use of the money to be expected

9. participation in start-up competitions

In a start-up competition you compete against other founders with your business idea. They are usually organized by public organizations or companies and give you the chance to pitch your project and finance your startup, among other things. For example in the form of Prize moneybut also with the help of investors who become aware of you.

Well-known start-up competitions are for example the "Berlin-Brandenburg Business Plan Competition", "COURAGE - THE NRW 2024 FOUNDERS' AWARD" or the "Green Alley Award".

Advantages:

- Ideal springboard for the search for investors

- Direct feedback on the business idea and advice from experts

- Increased visibility and positive publicity for your startup

Disadvantages:

- Intense competition and high demands on presentation

- Time and resources required for preparation and participation

- Limited chances of winning with a large field of participants

Good to know: There are also ideas competitions where only the business idea is presented first. Business plan competitions are also an option to get money for your start-up financing and to get qualified feedback.

10. incubators and accelerator programs

Incubator and accelerator programs are another way for young founders to raise money for their startup. They are usually offered by universities, public institutions or even large corporations - and provide you with professional start-up support in the form of capital, coaching, infrastructure, experience and a network.

The aim of incubators is to Developing your business idea in the early phase, while accelerators usually start a little later and support the Growth of an existing business model promote.

Advantages:

- Access to funds, resources and expertise

- Structured, targeted support and advice for your project

- Access to a large network of founders and investors

Disadvantages:

- High application workload and intense competition

- Long decision time until approval or rejection

- In the case of follow-up financing, parts of the company usually have to be sold

Mastering startup financing with different means!

Financing a start-up is of course a crucial phase on the road to success. It puts your young company on a solid footing, creates security and growth potential - and gives you the chance to generate added value for yourself, our environment and our society.

Whether it's equity financing, a start-up loan, a scholarship or financial support from your family and friends - today you have learned about some financing options that you can can of course also be combined with each other depending on what makes sense for you and your start-up idea.

"A person with a new idea is a crank until the idea succeeds."

Mark Twain (more at Founder quotes)

I hope this article helps you to find the right financing strategy for your business. Do you have any questions, suggestions or do you know of other financing options that should not be missing here? Then feel free to write me a comment.

Stay innovative and optimistic,

PS: Sometimes it's just a few habits that make the difference between success and failure. As a further source of motivation and inspiration, I would therefore like to share the most important habits with you next. Introducing habits that characterize successful entrepreneurs.